While the global insurance industry seems to be eyeing every cloud mass in the Atlantic Ocean for the development of the next possible named storm and what might unfold in terms of overall activity and landfalls, the industry should also pay attention to a different type of weather forecast. Some similarities can be drawn between the lower 48-state fire season and the Atlantic hurricane season in that they are both off to fairly quiet starts. There is curiosity within the industry as to whether the back half of both of these seasons will be hyperactive.

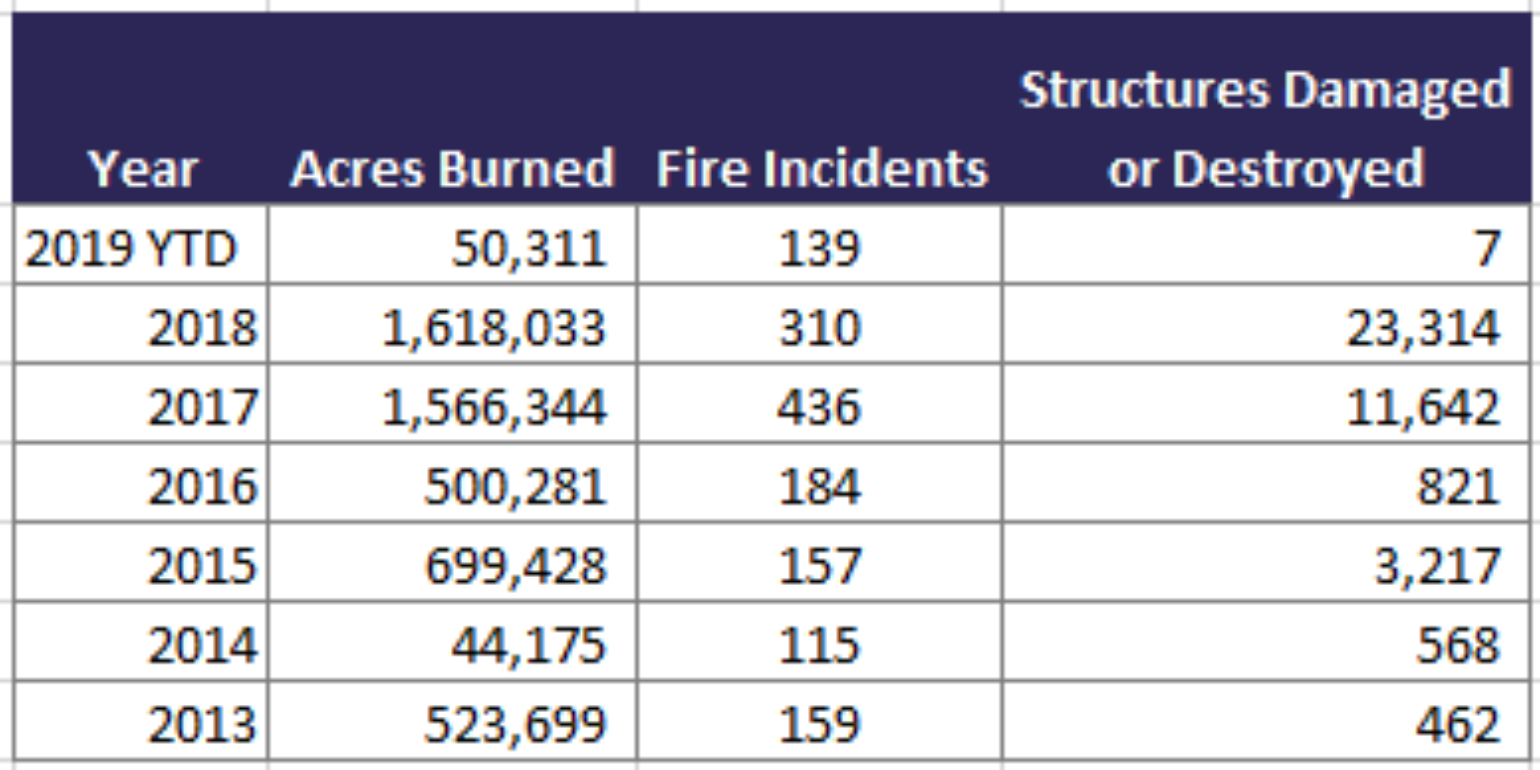

With a total of over $33B of North American wildfire insured loss since 2016, it’s clear that wildfire has taken on new importance in the insurance industry. The good news is that much of North America is exiting the core of the fire season and, so far this summer, there has been a welcome wildfire reprieve. In California, only 24,579 acres have burned this year as opposed to 621,784 acres last year (CAL FIRE Only stats to Aug 22). The other bit of good news is that California has only about 6.73% of the state under abnormally dry conditions, with no drought conditions being reported. This is a vast improvement from one year ago when 47.19% of the state was reporting drought conditions.

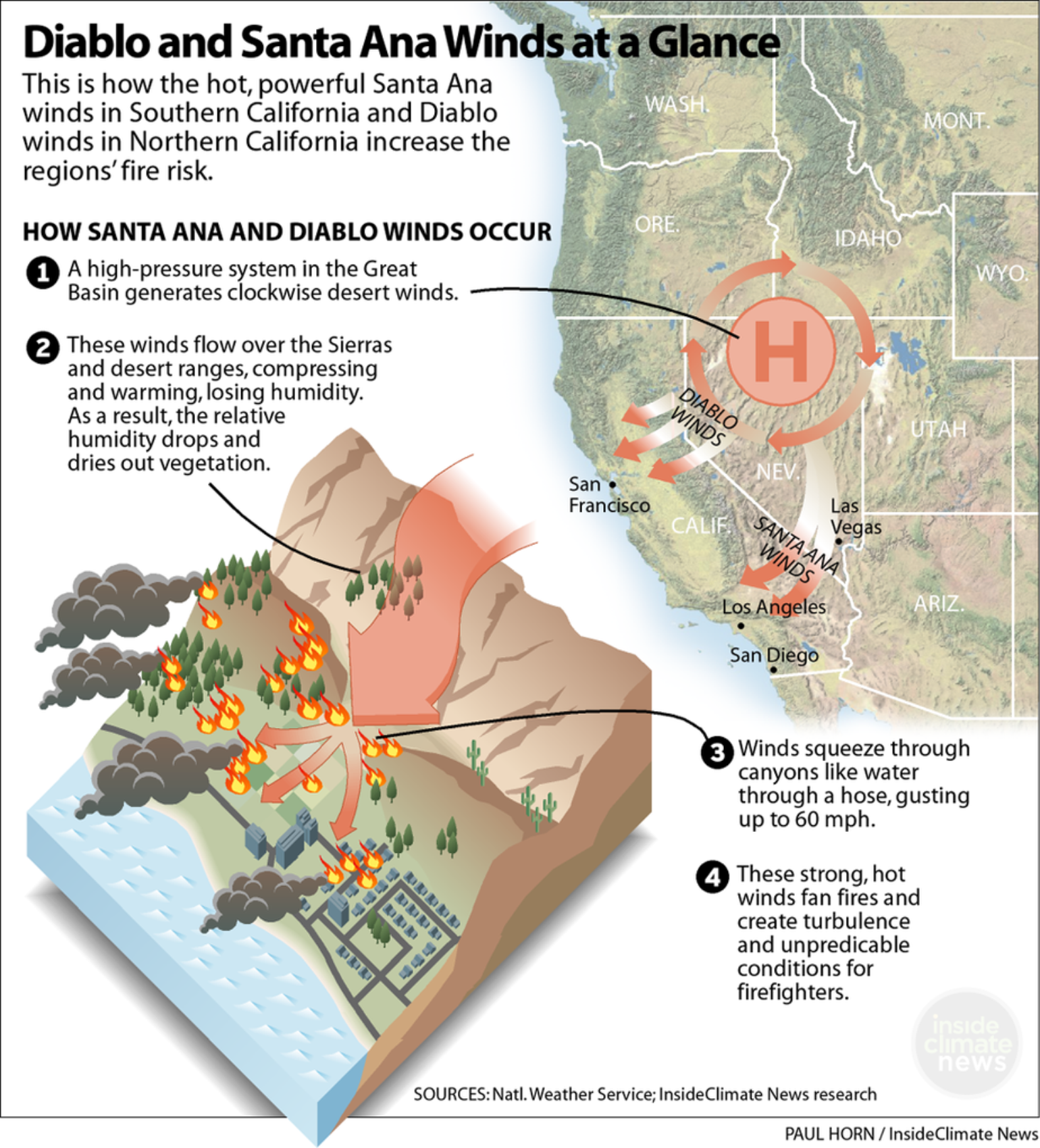

There is still much of the fire season remaining, including the most dangerous time of year when strong, dry offshore winds peak during the months of September, October and November and have, historically, been associated with the majority of California’s worst fires. The Santa Ana and Diablo winds which, when combined with abundant fine fuels, can lead to elevated fire activity, even if the current fire risk is low. In fact, after a fairly wet winter, the abundance of fine fuels, such as annual grasses, has increased, which adds to the fuel load across the region. As these fuels dry out, there is significant risk if a fire starts and high winds are present.

The National Interagency Fire Center is one of the official sources for wildfire assessments and outlooks. According to its forecast, the areas of greatest concern continue to be the lower and middle elevations across California, the northern and western Great Basin, and portions of the Pacific Northwest where the robust grass crop has cured and can become an easy source of fire.

Since the halfway point of the western wildfire season has passed, there are some signals that point towards an active, compressed, season across the west as the southwestern monsoon becomes more active. While this will effectively end the fire season across the southwest, lightning-induced fire activity is expected to increase elsewhere. And, since humans cause the majority of wildfires, risk is always present. When accidentally or intentionally set fires are combined with wind events, which have been largely absent thus far, but will intensify in frequency by mid to late month as dry frontal passages become more common, the risk of wildfire will also increase. Wind events and low humidity will contribute to a likely increase in fire occurrences into the start of November.

Unlike a hurricane, which often provides the insurance industry with a few days’ notice to determine expected loss, devastating fires often occur at a moment’s notice. The best thing the insurance industry can do is practice good accumulation management now, acknowledging areas that could become the next Paradise, California. Recent work by Pamela Ren Larson and Dennis Wagner at azcentral.com concluded that there are as many as 526 locations with a higher wildfire potential than Paradise, CA. In the absence of a newer, sophisticated catastrophe model, the insurance industry can still use Larson and Wagner’s very thoughtful analysis to determine the overall risk to a portfolio via a simple risk score. Although their analysis looked at the hazard, it also tried to understand the overall human risk, which life and casualty lines should contemplate.

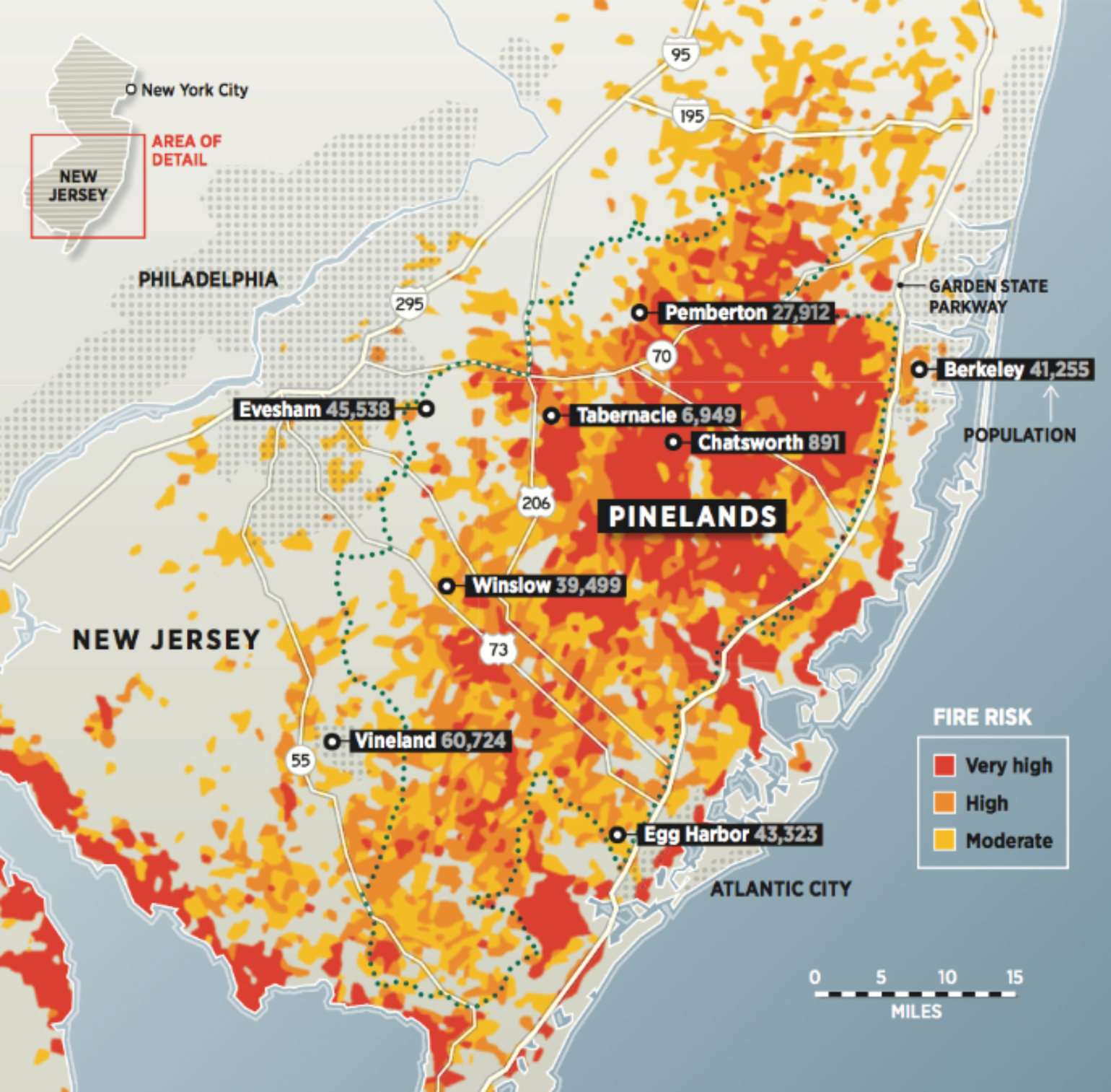

The insurance industry may also want to consider analyzing areas outside of the western U.S. that could become the next Gatlinburg, Tennessee. For example, the 1.1 million acres of Pine Barrens in New Jersey, which is mostly rural despite the proximity to the sprawling metropolitan cities of Philadelphia and New York City, could result in a major insurance industry loss. There are vulnerable locations along the wildland-urban interface where fires are common. At some point, the weather conditions will be right to create a worst-case scenario, which could impact towns like Tabernacle or Barnegat Township in New Jersey. Thankfully, the peak of the wildfire season in New Jersey is during the spring months.

Another recent concern is the increased wildfire risk that has been created by Hurricane Michael across Georgia and the Florida Panhandle. According to the National Association of State Foresters, a total of 92 million tons of timber, or roughly 4 million truckloads of timber, were destroyed by Michael’s fierce winds. The volume of dead and downed fuels will likely contribute to an increase in the number, intensity, and duration of wildfires over the next three to ten years. According to the Association, there are typically 4.87 tons per acre of available fuel in Florida. Currently, the average is up to 58 tons per acre - a ten-fold increase. In a catastrophic area, there are over 100 tons per acre. In fact, analysis done by the Southern Wildfire Risk Assessment Portal puts 49 communities at risk in the catastrophic wildfire zone and 194 communities at risk in the severe wildfire zone. Again, much like New Jersey, the highest likelihood of wildfire across this region is in the spring.

While the wildfire season will likely end up being below normal in terms of acres burned for the western U.S., it only takes one fire under the right conditions to make a memorable season. Significant wildfires can occur even when fire conditions are not extreme. Therefore, it is beneficial to understand wildfire risk accumulation and determine what is a comfortable level of loss by simple aggregation analysis or using new sophisticated wildfire models. These models have suggested that recent wildfire seasons are on the order of a 30 to 60-year return period, so none of the recent U.S. wildfires are considered tail events. Instead, these events have low return periods of less than 100 years, which reflects increasing U.S. wildfire risk in large part due to development of the wildland-urban interface. Insurance companies should understand this risk due to the proliferation of wildfire-prone areas throughout the U.S.