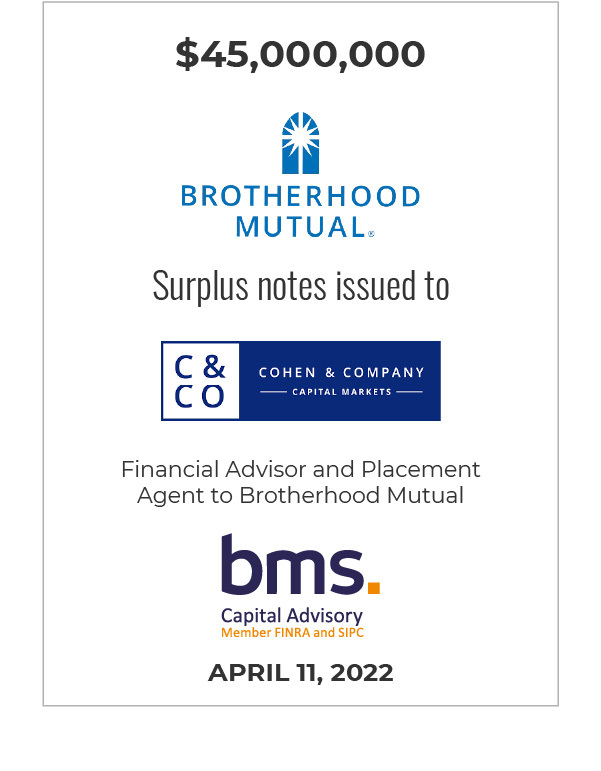

BMS Capital Solutions & Advisory provide strategic expertise in various areas including Mergers and Acquisitions (M&A), Legacy Solutions, Private Capital Raising and Insurance Linked Securities (ILS).

The team adopts a holistic, solutions orientated approach, leveraging the extensive knowledge, experience and expertise of our analytics, rating advisory and brokerage experts to deliver specialised and in-depth solutions. With our presence in the US, Bermuda, and UK we provide access to deep pools of capital on an international basis.